Pharmacy Benefits

Generics and Biosimiliars | Back to the Future

Generics and Biosimiliars | Back to the Future

Is your plan taking full advantage of savings with generic and biosimilar drug options? Generic and biosimilar savings help offset growing brand drug expenses, make medications more accessible for patients and support the sustainability of prescription benefits. This Capsule article explores metrics to monitor the use of generics and biosimilars, examines marketplace changes impacting these metrics and reviews benefit options that support the use of these lower-cost options. How close are your generic and biosimilar metrics to optimal performance levels?

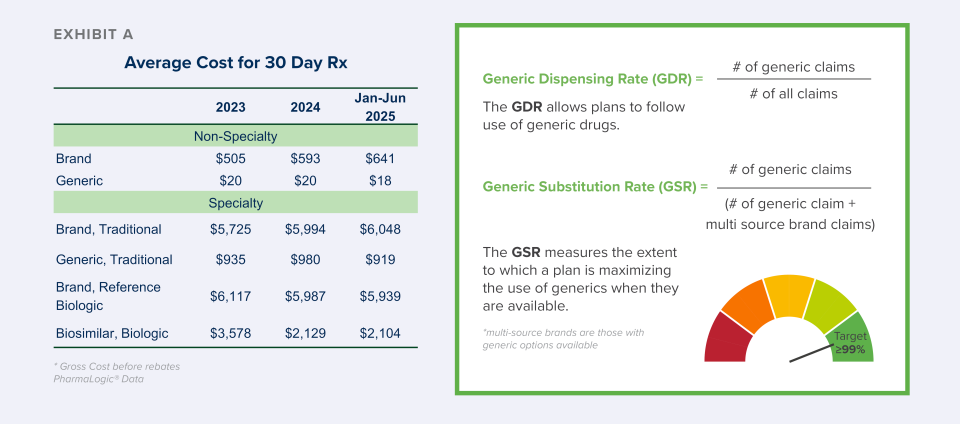

Some may think that talking about generics is timeworn and outdated. That view is itself outdated. A focus on generic and biosimilar savings is more relevant than ever as plans struggle to manage the higher cost of drugs. Review the difference between average brand and generic costs in Exhibit A on page 2.

Generic drugs and biosimilars are lower-cost versions of brand-name medications that become available after the original drug’s patent and exclusive marketing rights end. These alternatives are just as safe and effective, and they help reduce costs for both patients and plans.

Traditional drugs, often called small molecule drugs, are made via chemical processes. Lipitor, ibuprofen and aspirin are traditional drug examples.

Generics are available when brand patents expire.

Biologics are derived from living organisms and are large, complex molecules. Growth hormone, insulin and blood cell stimulating drugs like Epogen and Neupogen are biologic drug examples.

Biosimilars are available when brand patents expire.

Generics

For years, benefit plans have focused on promoting generics to help save plan dollars and offer lower-cost alternatives for patients. Finding ways to save benefit dollars is key to ensuring the sustainability of health benefits.

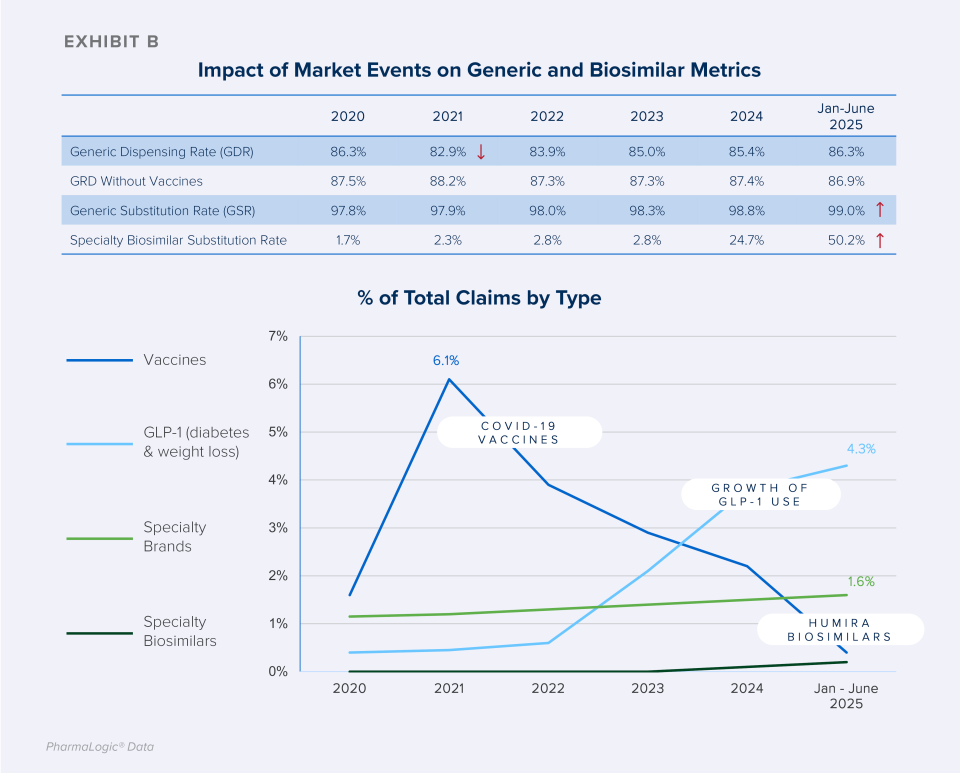

Following some recent market developments, generic dispensing rates (see definition below) have declined for many plans while the use of brand drug products has increased. These brand trends are contributing to lower overall generic claim percentages. Contributing factors include:

- Introduced in 2021, COVID-19 brand vaccine claims increased the use of brand drug claims that year and for the 2-3 years that followed.

- The increasing use of brand glucagon-like peptide-1 agonists (GLP-1) drugs for diabetes and weight loss (e.g. Ozempic®, Mounjaro®, Wegovy®, Zepbound®).

- The increasing use of specialty brand drugs to treat cancer, inflammatory conditions and rare diseases such as cystic fibrosis, multiple sclerosis, and more.

The Generic Substitution Rate (GSR) metric measures the extent to which a plan is maximizing the use of generics when they are available. This metric is a powerful tool because it is not influenced by new brands or a high vaccine year. To get the most value from available generics, Brown & Brown has identified a GSR target of 99% or greater and we are working with plans to achieve it.

Achieving a 99% or greater GSR involves plan design options that incentivize patients to choose generics.

- Drug formularies that exclude brands with generics available (multi-source brands)

- Copay designs that are higher for multi-source brands to inspire more generic use

- Step therapy rules encouraging use of generic options first before brands are authorized

Note: Metrics following the use of generics may vary by Pharmacy Benefit Manager (PBM) or consulting resource. Some will report generic dispensing only for non-specialty drugs or remove certain classes to boost results. Ask how the Generic Dispensing Rate metric is calculated in your reporting.

- Are claims for vaccines included in the calculation?

- Are claims for specialty drugs included in the calculation?

- Are claims for formulary brands included in the calculation?

Answers to these questions will help to better ensure a true apples-to-apples comparison.

Biosimilars

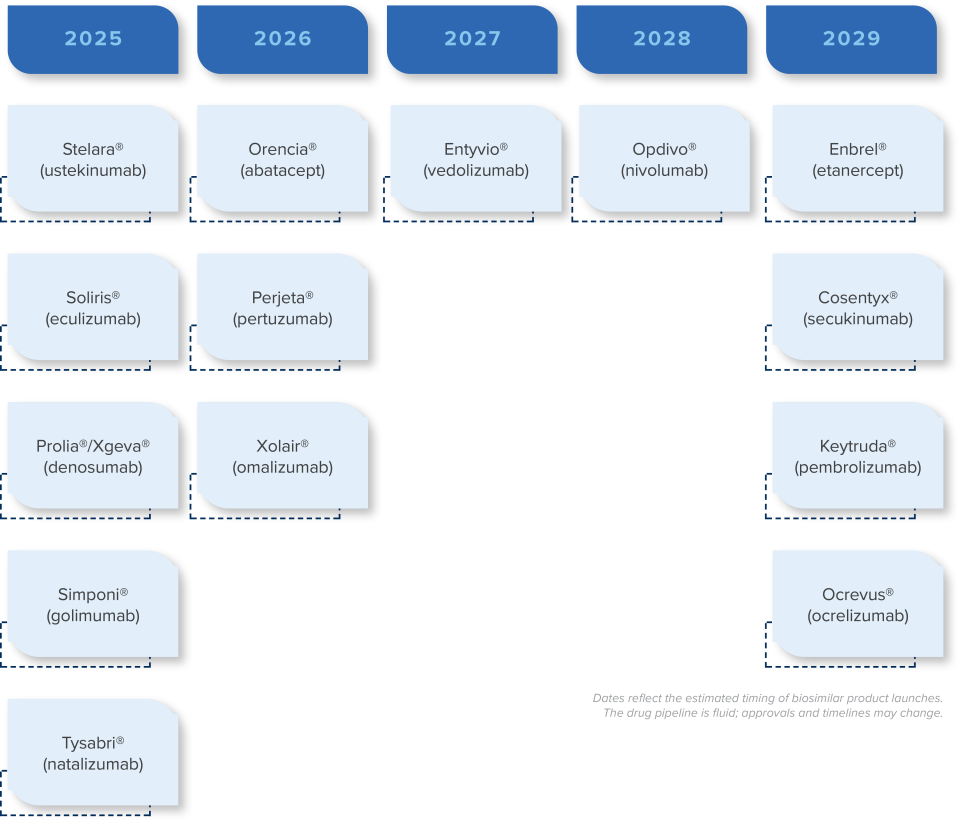

As with generics, when patents for brand biologic drugs expire, lower cost biosimilar options often become available. While biosimilars have been available since 2015, discussions about them became more prominent as Humira® biosimilars entered the market in 2024. Stelara®, Prolia® Xolair® and Soliris® biosimilars will present additional biosimilar savings opportunities for prescription benefit plans beginning in 2025.

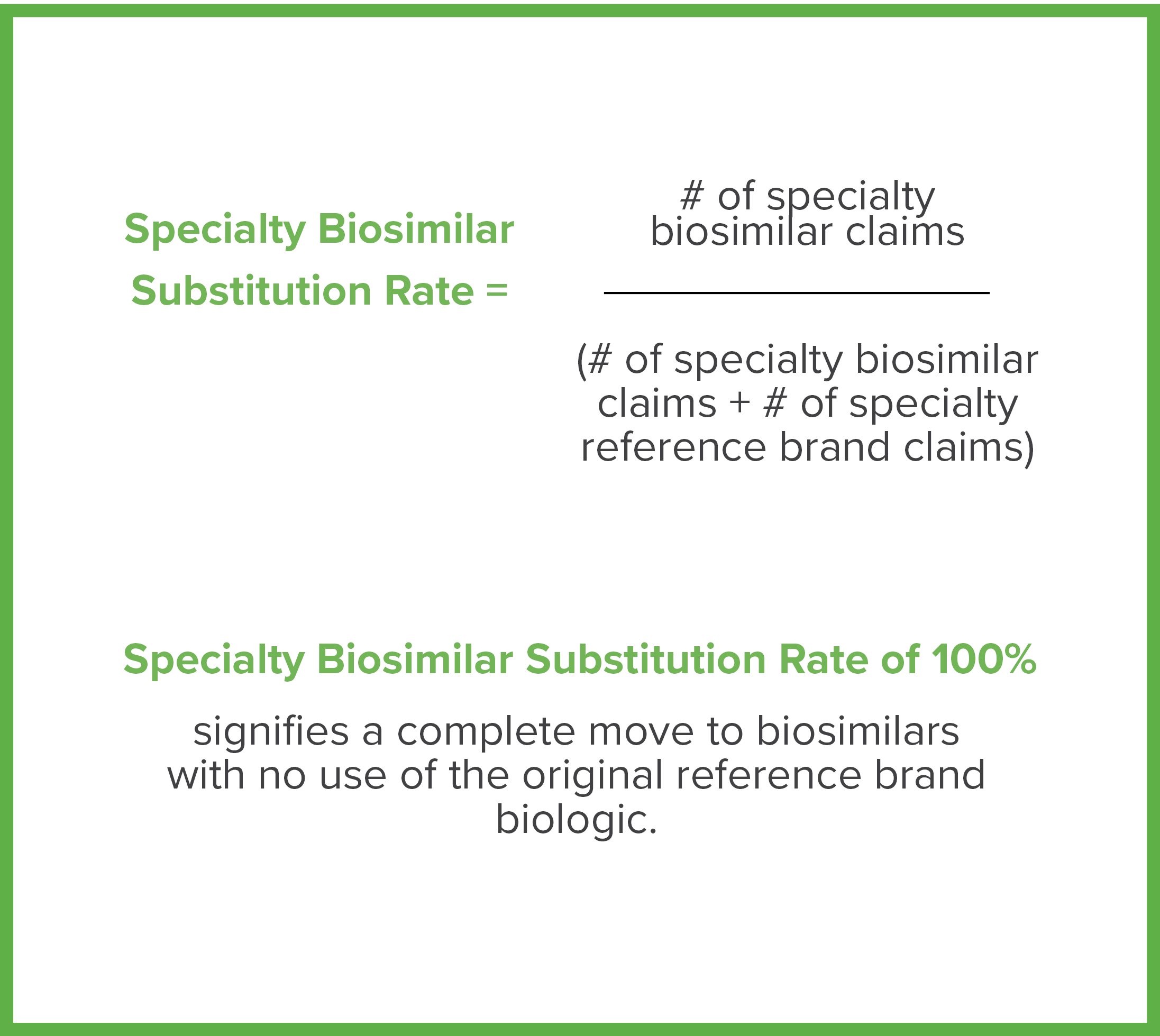

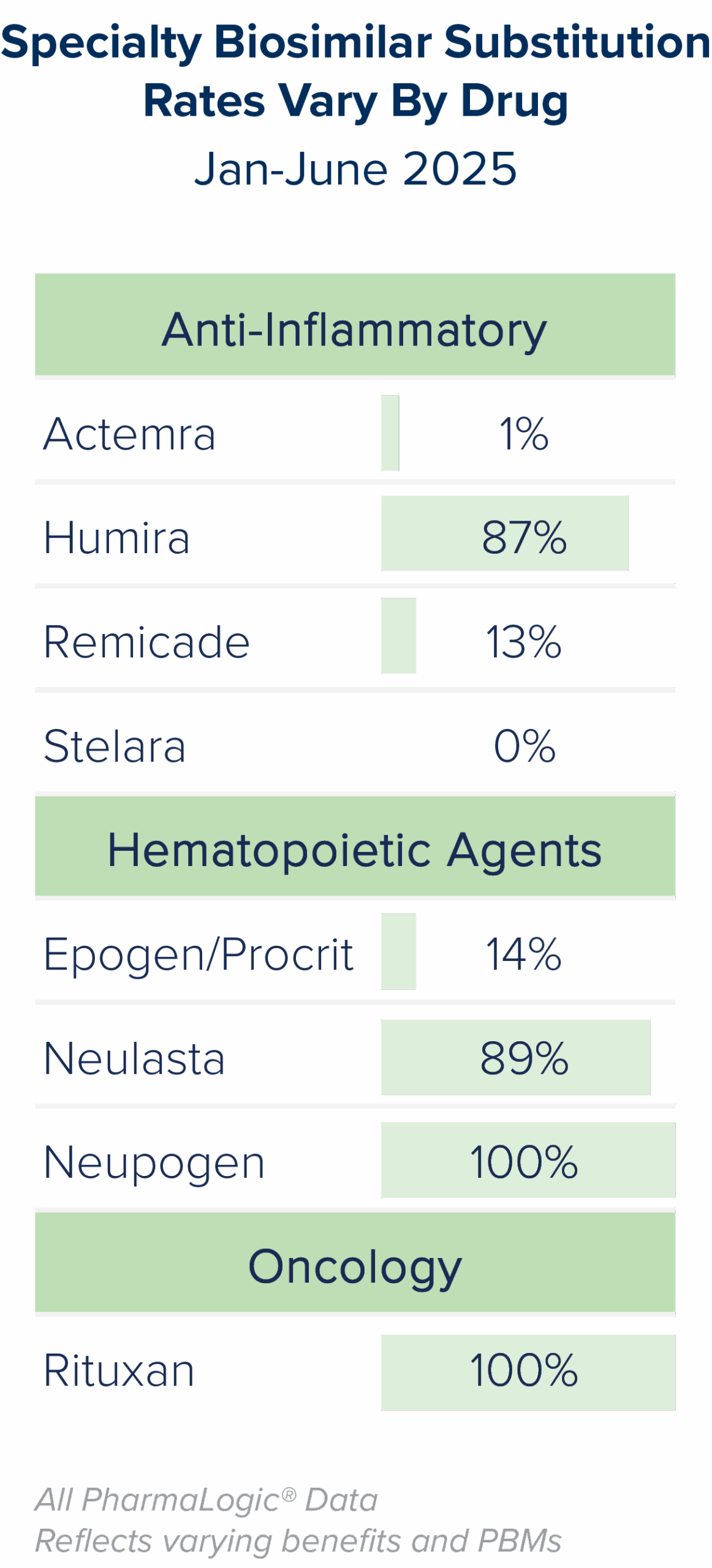

Brown & Brown’s PharmaLogic® analytics have defined a new metric called the Specialty Biosimilar Substitution Rate (see definition to the right). Similar to the Generic Substitution Rate, the Specialty Biosimilar Substitution Rate measures the extent to which a plan is maximizing the use of biosimilars when they are available.

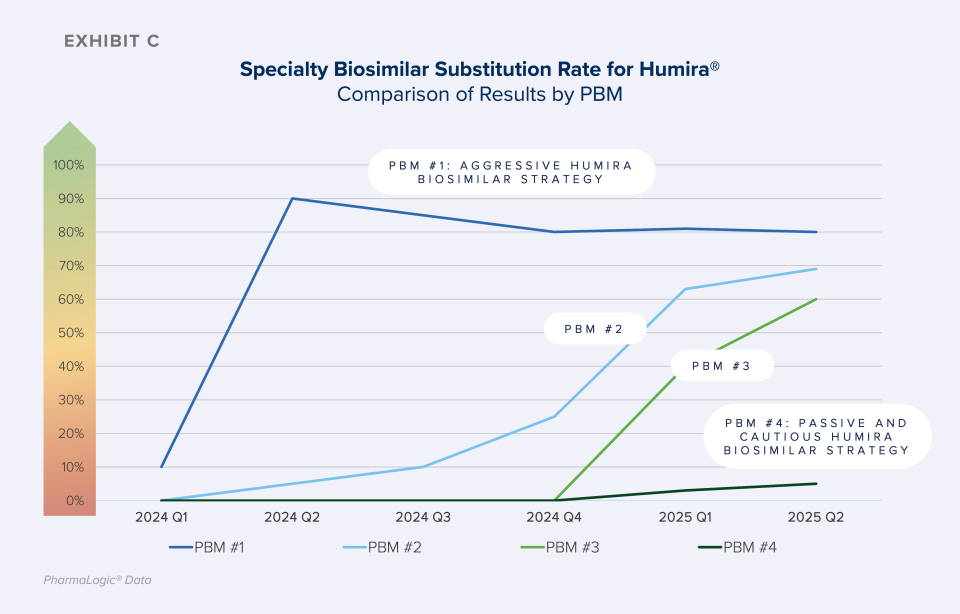

As shown in Exhibit C, some PBM formularies are quickly progressing from offering both original brand biologics and biosimilars to preferring only the lower cost biosimilars, increasing Specialty Biosimilar Substitution Rates. Aggressive strategies result in rapid and meaningful uptake of biosimilars.

Consider plan design options that encourage use of biosimilar options, such as:

- Focused and aggressive formulary strategies to prefer biosimilars and exclude coverage of the reference/ originator brands are key to achieving the greatest biosimilar savings.

- Ensure aggressive incentives are in place to encourage use of Humira®, Stelara®, Neupogen®, Remicade®, Neulasta®, Xolair®, Prolia® and Soliris® biosimilars.

- Press PBM partners to demonstrate savings net of rebates to help ensure success with biosimilar strategies.

- Prepare for biosimilar opportunities around the corner. See the chart below.

Biosimilar Pipeline

Generic and biosimilar medications offer substantial savings to patients, employers, health plans and the U.S. healthcare system. Many generic and biosimilar options offer savings of 80% or greater before rebates are considered when compared to their brand counterparts. Savings from generics and biosimilars, even net of brand rebates lost, can be substantial.

Our team is ready to assist you as you face prescription benefit challenges and contemplate benefit changes and potential solutions. Together, we can review strategies with PBMs, including optimizing formulary incentives to support the use of generics and biosimilars.