Property & Casualty

2025 Financial Institutions Market Survey

2025 Financial Institutions Market Survey

Executive Summary

Brown & Brown is excited to publish our annual Financial Institutions Market Report, which is dedicated to surveying the state of the financial lines and cyber markets for financial institutions. Our survey focuses on three subsegments (banks, asset managers and insurance companies) and four product lines (cyber, D&O/management liability, professional liability and bond/crime insurance). We surveyed the financial lines and cyber authorities at twelve prominent carriers from the U.S. and London with questions ranging from market conditions to underwriting appetite. This year’s survey additionally inquired about the top risks concerning FI underwriters and year-over-year

trends in claim activity.

Financial institutions continue to navigate a complex and evolving risk landscape in 2025. Notwithstanding a more permissive regulatory environment in the U.S., there remains a continued focus on elevated exposure to operational, cyber and reputational risks. Key concerns among underwriters include increasing claims related to cyberattacks, social engineering fraud, AI implementation and commercial real estate exposures.

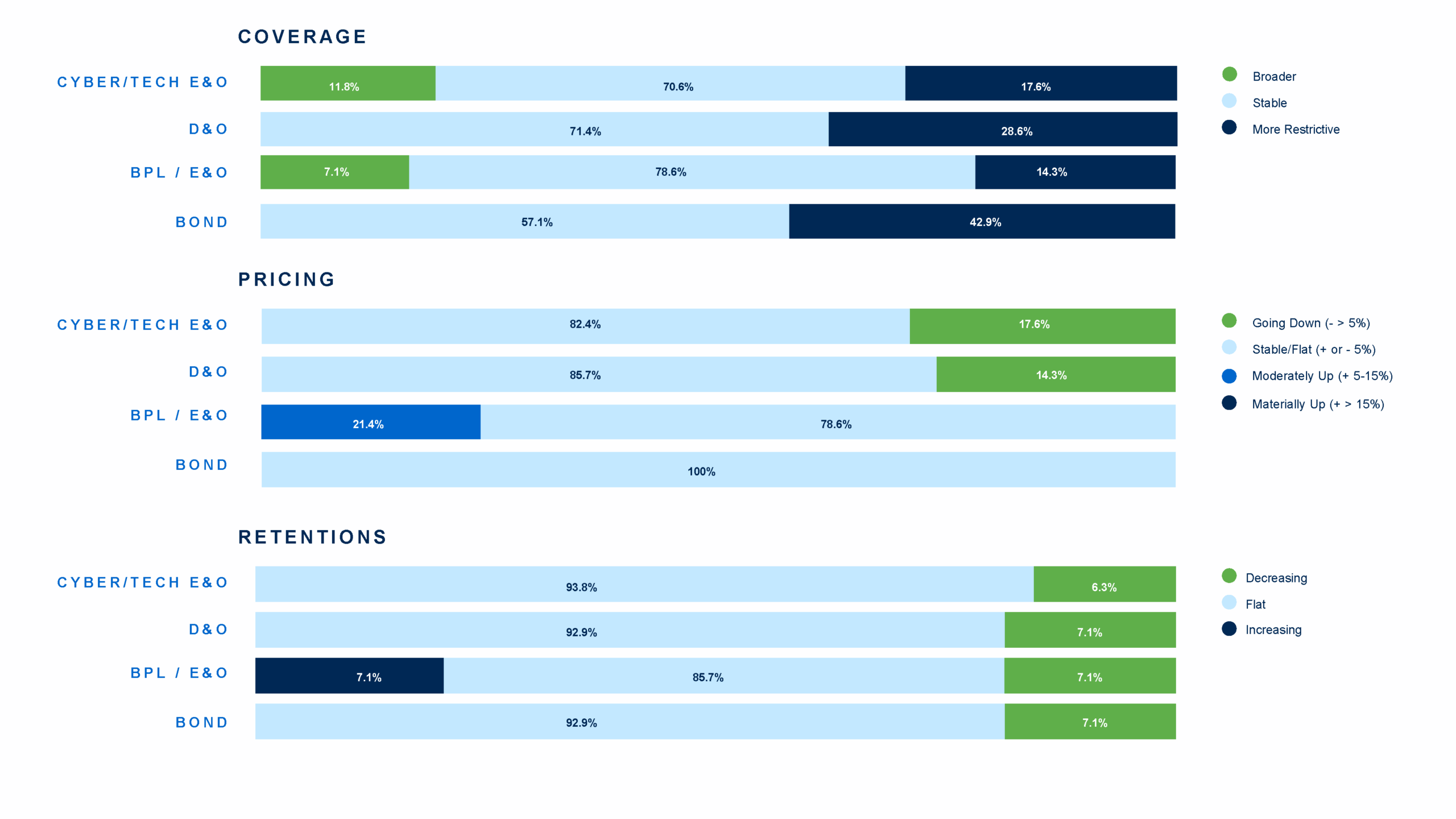

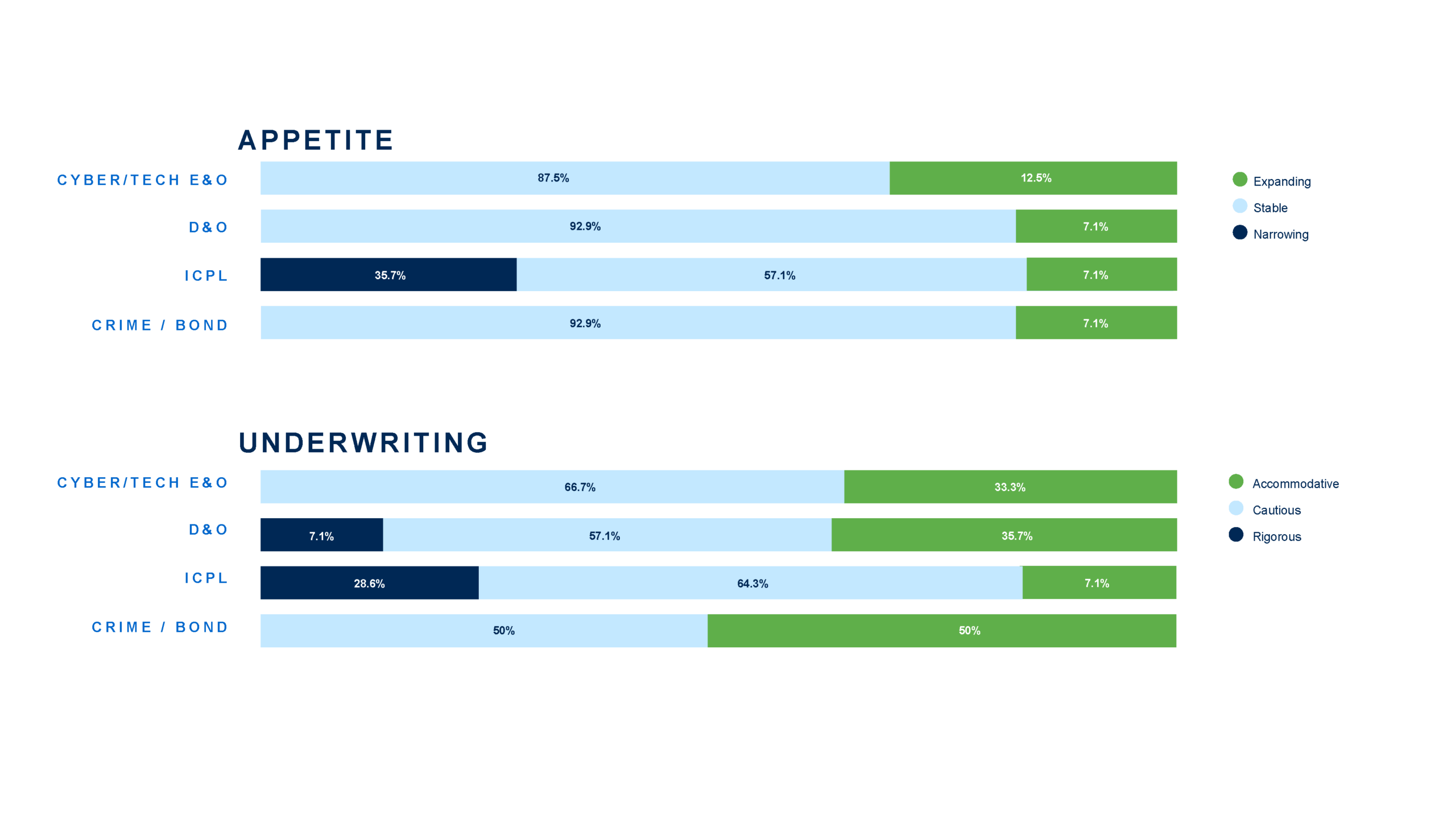

Despite the heightened risk environment, insurance market conditions remain favorable across most financial lines. Coverage terms and capacity are generally stable to expanding, and pricing is competitive, particularly in Cyber and Directors & Officers (D&O) lines. Most underwriters reported stable or broader coverage terms, with only limited tightening noted in Bankers Professional Liability (BPL) and Cyber.

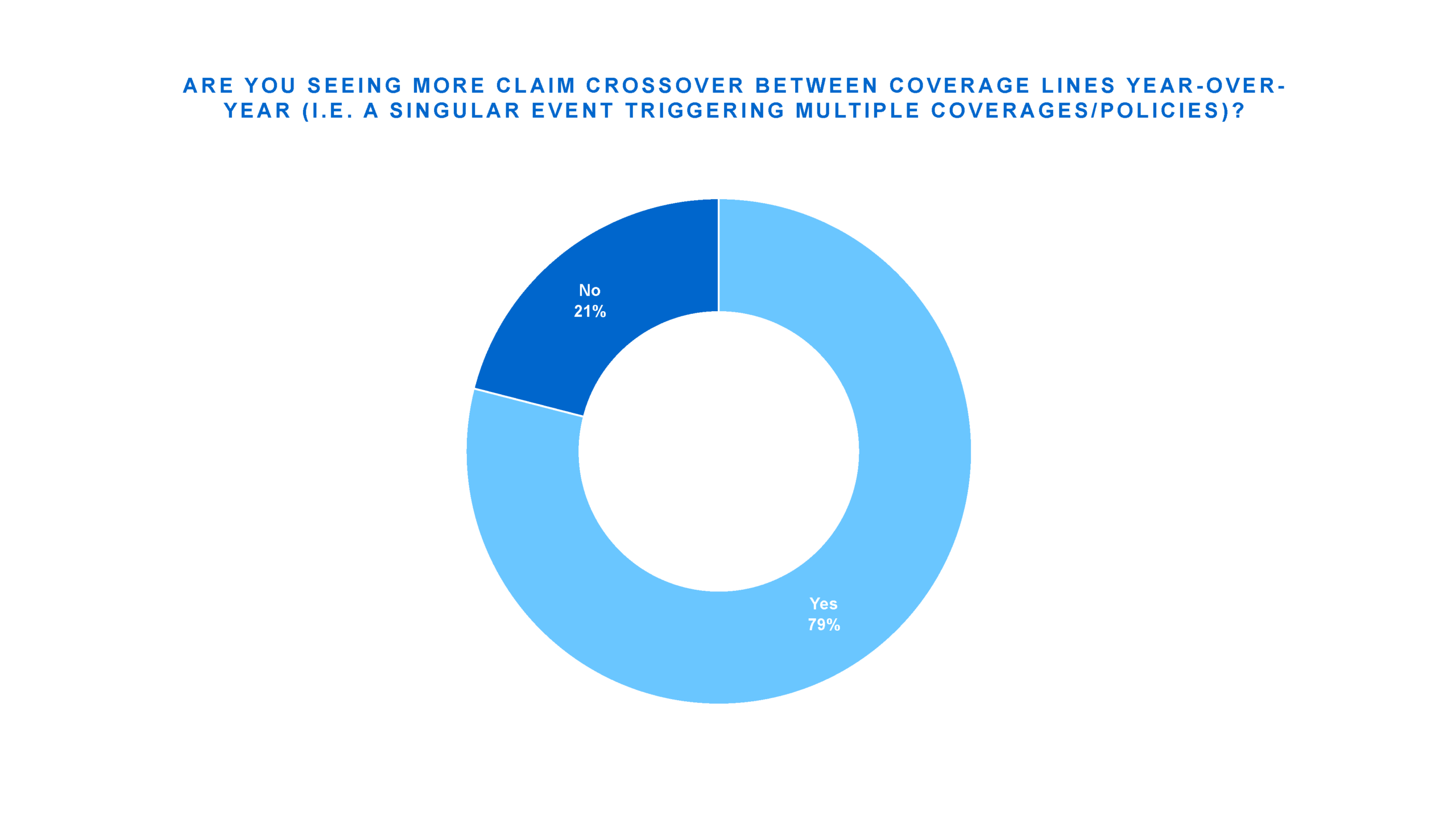

The survey data highlights a rising trend in multi-policy claims crossover, driving carrier interest in bundled and blended products to help customers manage correlated risks more effectively. Notably, seven carriers now offer all four major lines (Cyber, D&O, BPL/E&O and Fidelity Bond) on a primary basis, up from four last year.

Segment-specific insights include:

- Banks face elevated operational risk, but insurance appetite is strong. Pricing is largely flat with modest increases in BPL. Underwriters are increasingly concerned about the credit cycle and digital fraud.

- Asset managers benefit from competitive pricing and stable retention levels. Carriers continue to expand appetite, with a growing focus on AI-driven investment risk and ‘cost of correction’ E&O coverage.

- Insurance companies encounter the most difficulty in Insurance Company Professional Liability (ICPL), driven by nuclear verdicts and natural disaster losses. However, D&O, Cyber and Bond markets remain attractive and competitive. That said, at the time of this report’s publication, the insurance sector has been targeted by the cyber threat actor Scattered Spider, underscoring concern around increased cyber claim activity.

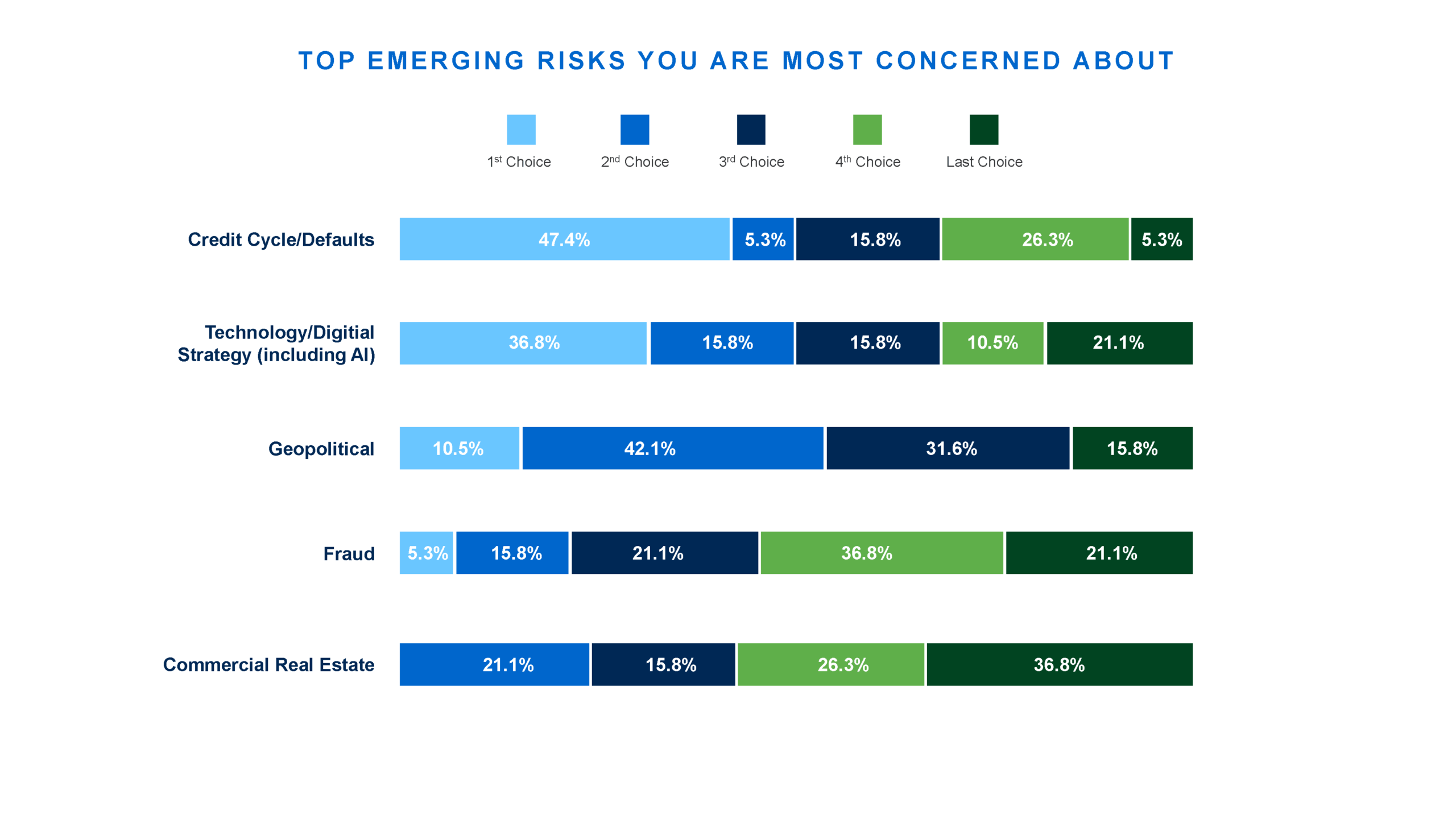

- Cyber market stability continues, with carriers differentiating through pricing, coverage enhancements and value-added cyber services. Systemic events and evolving privacy laws remain top concerns, with 43% of underwriters citing geopolitical risk as a key emerging threat.

Overall, while non-financial risks are intensifying, the insurance market remains accommodative, with carriers competing for quality risks. Financial institutions are encouraged to evaluate their programs proactively and consider enhancing protection while market conditions are still favorable.

Banks

The risk landscape for banks remains challenging despite the anticipated lighter touch regulatory regime in the United States. Operational risks will remain relevant when contemplating new digital initiatives and strategies. Cybersecurity, fraud (both digital and old school check fraud), third-party risk, AI implementation and digital disruptions will keep banks focused on their non financial risk frameworks. A more relaxed regulatory regime could elevate risk around increased mergers and acquisitions activity and reinvigorated digital asset strategies. Our survey noted that Financial Institutions (FI) underwriters are also concerned about where we are in the credit cycle and challenged real estate exposures.

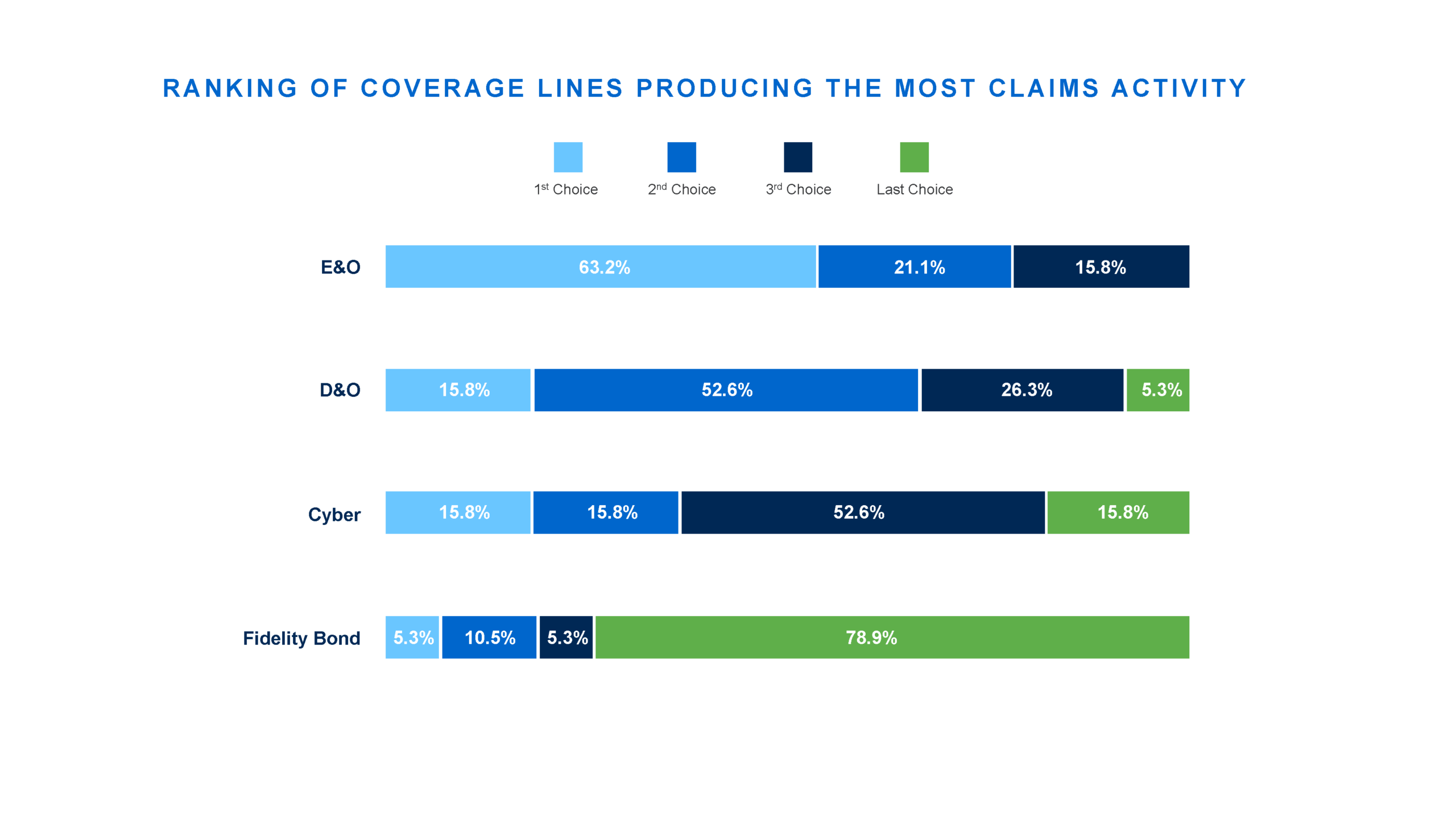

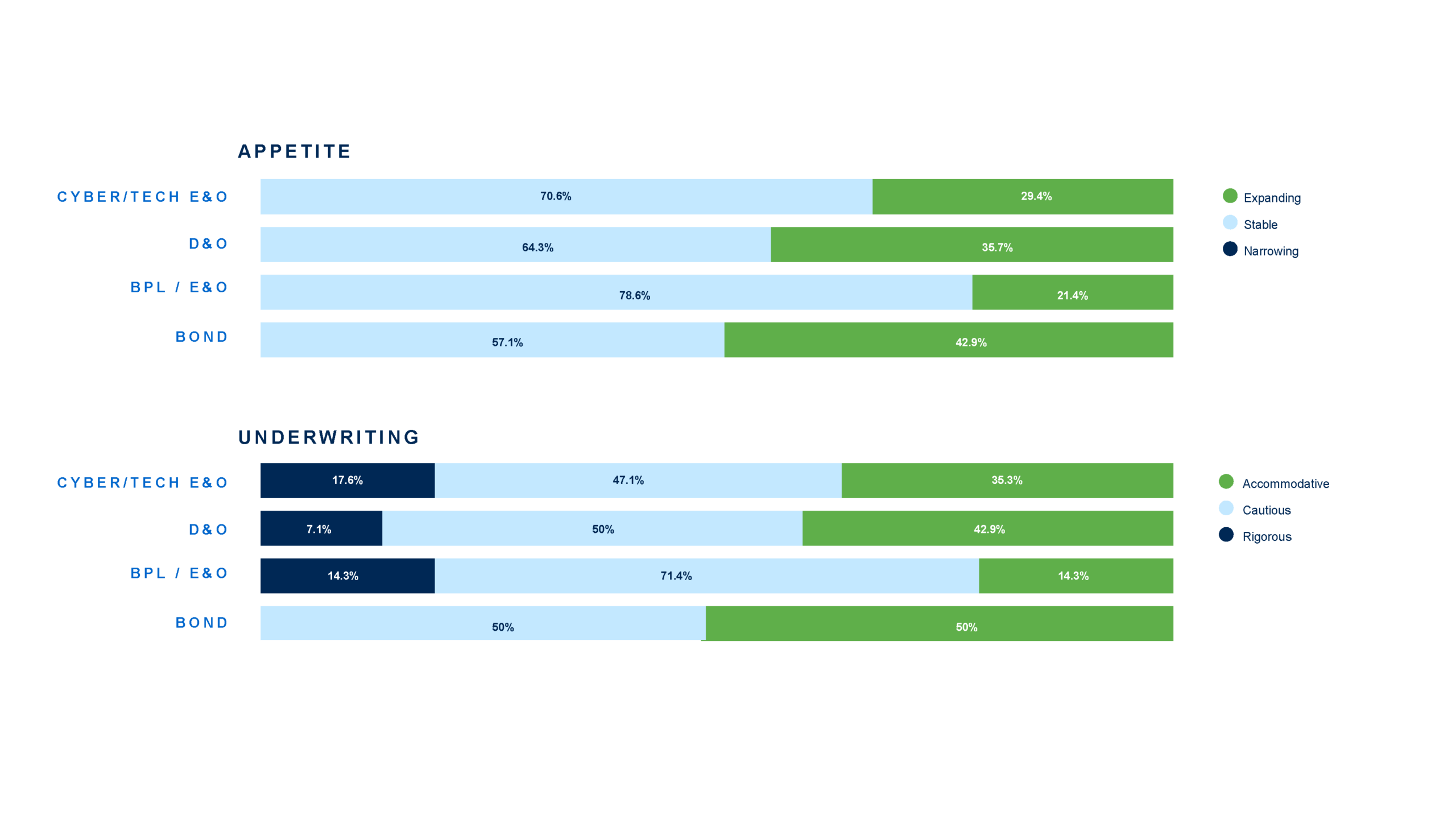

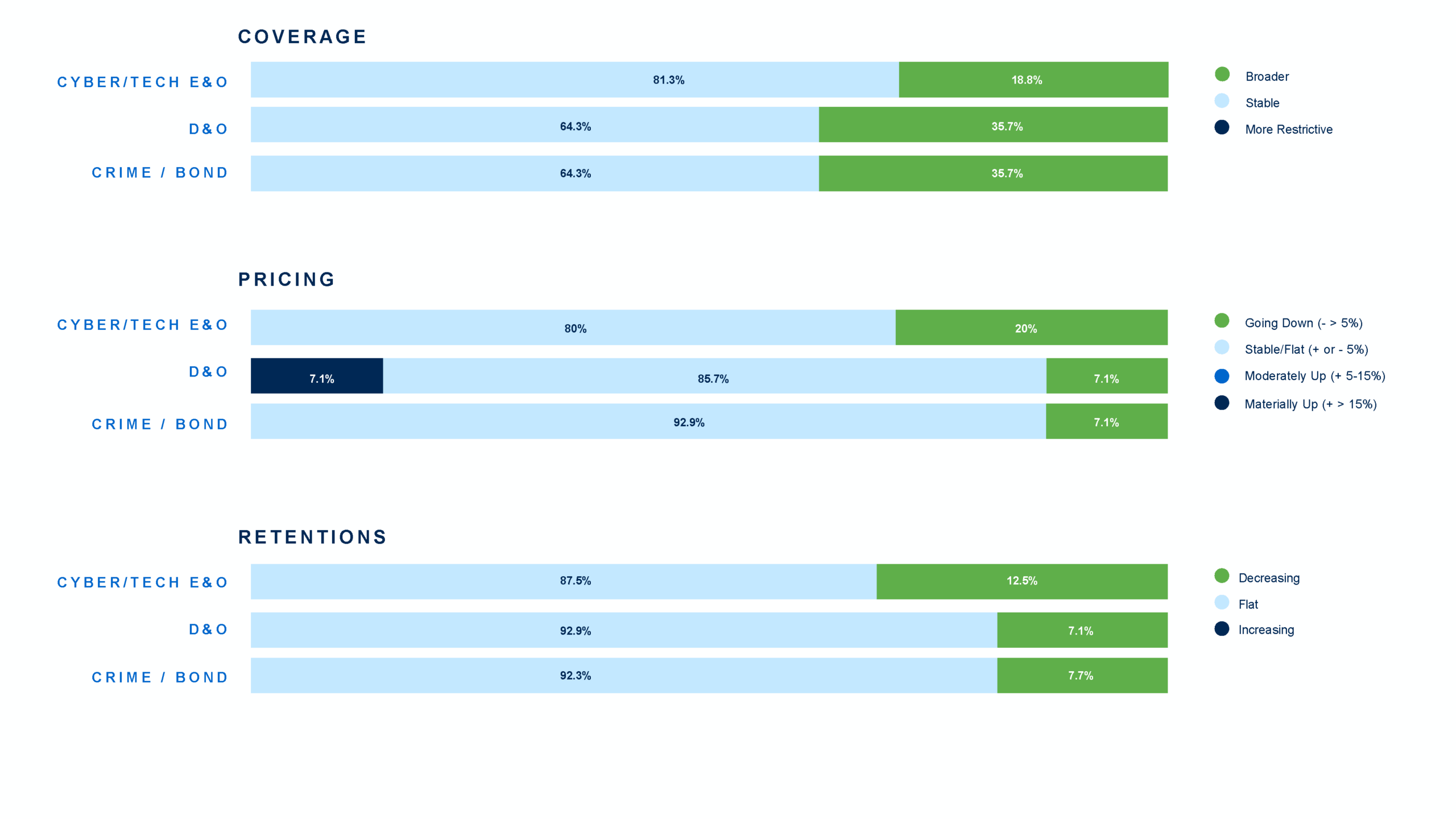

As reflected in our survey, we see that the Error & Omissions (E&O) and Directors & Officers (D&O) product lines are producing increased claims every year. Some underwriters also cited losses on the fidelity bond due to more frequent social engineering and check fraud losses. With this in mind, it’s a good time for banks to be in the insurance markets. The Financial Lines and Cyber markets for banks remain competitive. Coverage terms and conditions remain stable, with some markets showing expanded appetite across all four products. Only 12% and 7% of underwriters polled indicated more restrictive terms for Cyber and Bankers Professional Liability (BPL), respectively. Pricing remains stable with some softening in Cyber and D&O. 21% of BPL underwriters indicated pricing is up moderately (5-15%). Appetite is stable to expanding across all four product lines.

As mentioned in the Introduction, 79% of markets are seeing more claim crossover between coverage lines each year. This means that single claims are impacting multiple policies more frequently. Notably, we saw that seven markets are now able to write all four product lines on a primary basis (compared to four markets last year). This enables the blending of coverage lines to eliminate basis risk across correlated coverages with regard to emerging technology risks.

In summary, despite the markets citing a challenging risk and claims environment, terms, pricing and appetite are generally favorable for the banking segment. It is therefore a good time for banks to consider investing a bit more in their insurance programs in case this market environment proves unsustainable.

Asset Management

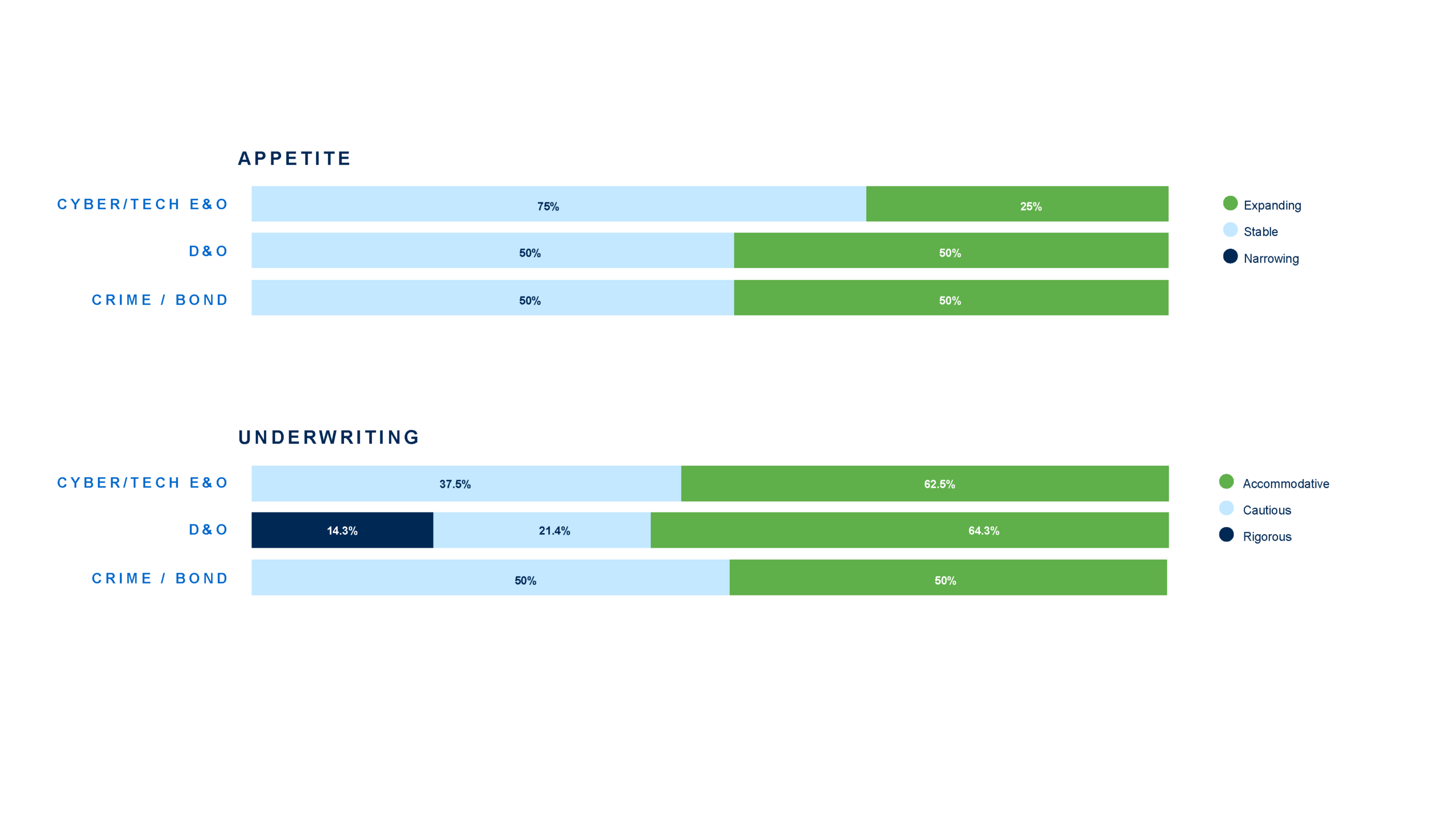

The asset manager marketplace remains a key growth target for insurance carriers, driven by historically favorable profitability and lower frequency of claims compared to other segments within the FI space. Overall, competition remains strong among both traditional markets and new entrants, keeping premiums and retentions stable for most buyers, as capacity remains abundant. At least 50% of underwriters surveyed described their underwriting guidelines as ‘accommodative’ across all financial lines for asset managers. Additionally, 50% of D&O/E&O and Crime/Bond underwriters reported their appetite is expanding, while 36% indicated their coverage offerings are broadening across these lines. Insurers are seeking competitive advantage through expanded coverage terms and widened underwriting appetites in an already dynamic pricing and retention environment.

Buyers facing larger premium and/or retention increases at renewal are typically those with recent claims activity or substantial exposure growth. For all other accounts, average renewals are trending flat or within a ±5% range. ‘Cost of correction’ coverage often tied to trade errors – continues to be a frequent source of E&O claims. Helping to ensure this coverage is properly addressed within a buyer’s policy is essential as it helps mitigate the financial and reputational impact of trade errors before they escalate into litigation.

It is imperative that asset managers take a rigorous, proactive approach to internal risk management to help mitigate their exposure to D&O/E&O, Cyber and Crime/Bond claims. Robust operational controls and compliance frameworks are critical, as are prompt and transparent communication with customers. Use of automation to reduce manual errors, strong documentation systems and regular staff training are equally vital.

As artificial intelligence (AI) driven investment tools gain traction across the industry, new risks are emerging related to their implementation and ongoing effectiveness. Firms must remain vigilant to shifting regulatory enforcement trends and evolving investor expectations surrounding AI use.

Although it is still early in the new administration, the regulatory environment is widely expected to shift toward a more laissez-faire posture in the coming years. With expectations of fewer SEC enforcement actions and a more permissive stance on cryptocurrencies, underwriters surveyed remain optimistic about continued growth in this segment. That said, they are closely monitoring evolving regulatory developments and emerging risks – including credit risk, implementation of AI and concentrated commercial real estate exposures – to determine whether adjustments in underwriting philosophy will be required to sustain profitability over both the short and long term.

Insurance Companies

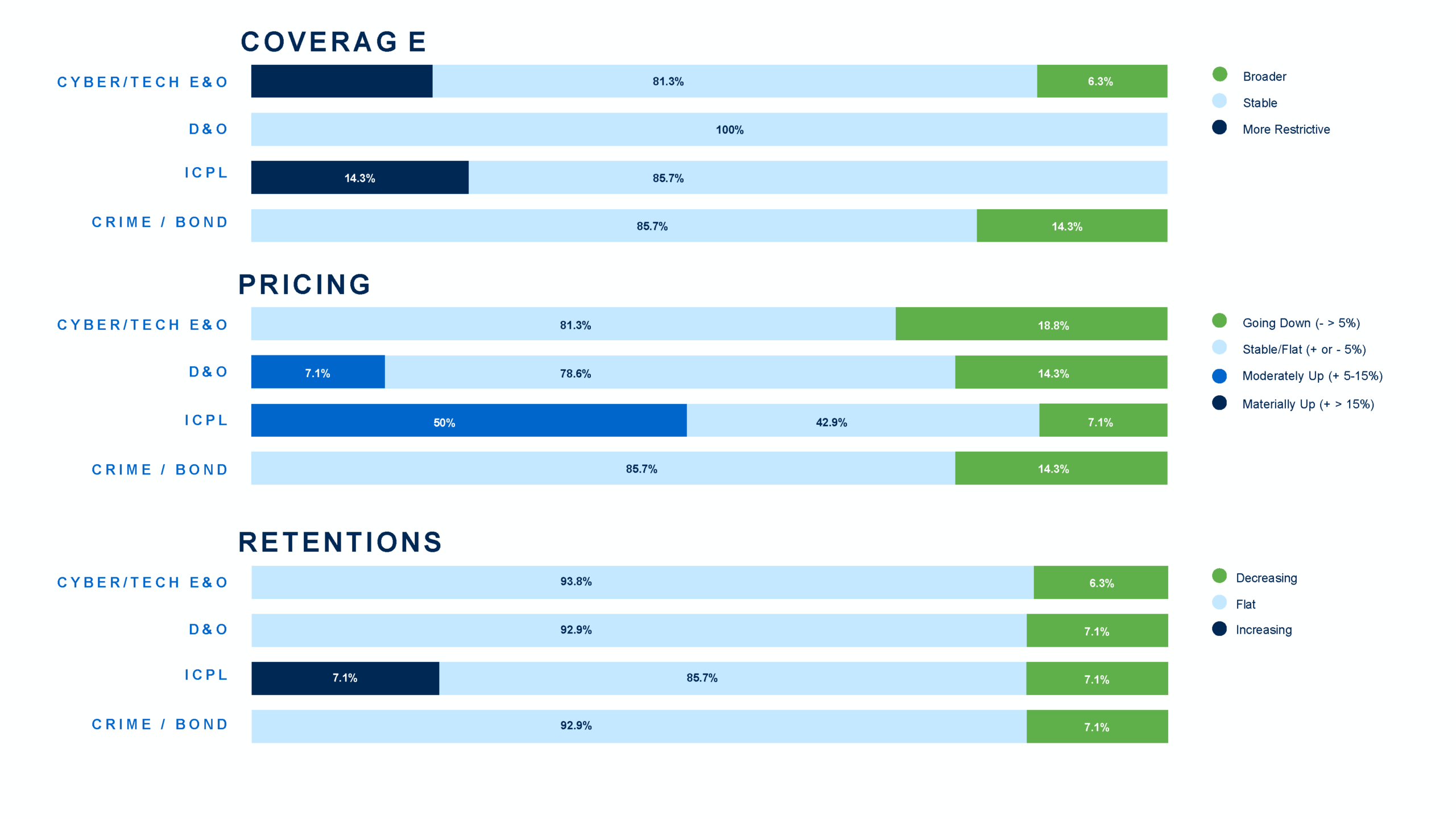

The insurance company sector continues to face challenges stemming from loss experience tied to nuclear verdicts, catastrophic natural disasters and social inflation. Insurance company professional liability (ICPL) remains the most difficult coverage line for underwriters. This is reflected in our survey results, where nearly 36% of underwriters reported a narrowing appetite for this line of business, creating fewer insurers willing to write ICPL coverage. 50% of respondents indicated ICPL pricing is increasing, while retentions and coverage terms are generally stable – or, in some cases, tightening.

ICPL bad faith claims and resulting nuclear verdicts have arisen from disputes over whether insurers acted fairly in settling or defending claims involving a range of factors, such as medical bills, pain and suffering or underpaying or denying coverage for damage following natural disasters. Companies with greater personal auto, general liability or property coverage exposure in plaintiff-friendly jurisdictions face elevated inherent risk. States such as Georgia, South Carolina, Florida, Missouri and Washington are especially problematic from a bad faith ICPL loss perspective. Additionally, states like Florida and California, which are prone to significant natural disasters including convective storms and wildfires, carry increased risk as both the scale and frequency of these events have intensified in recent years, placing further pressure on insurer profitability.

It is essential for insurance companies to handle claims thoroughly and promptly, with clearly defined protocols in place. According to a June 2025 Claims Journal article, best practices include thoroughly documenting all claims activity, communicating clearly and in a timely manner with insureds and responding efficiently and reasonably to settlement demands. Insurers must also monitor the ever-changing state-by-state regulatory landscape to stay informed about new legislation that may impact bad faith exposure in the jurisdictions in which they operate. This is especially important in the evolving age of AI, as insurers look to integrate AI into claims handling processes – an emerging area that may give rise to new bad faith allegations.

In contrast, the complementary financial lines of coverage – D&O, Cyber and Crime/Bond – are viewed by underwriters as growth opportunities, given their historically stronger profitability compared to ICPL. Pricing and retentions remain relatively stable, while coverage terms and conditions are broadening in select areas.

In summary, the insurance company market remains relatively favorable, with ample competition except in the ICPL space. Underwriters are likely to have an increased appetite for D&O, Cyber and Crime/Bond lines to help support accounts that include ICPL. Underwriters continue to closely monitor developments in the judicial and political landscape, the frequency and severity of natural disasters and the evolving impact of AIon risk assessment, coverage and potential losses.

Cyber Market Considerations

The Cyber market has stabilized, with pockets of competition still driving insured-friendly pricing and coverage enhancements where those changes had not been made in prior years. Cyber capacity remains plentiful, with only a handful of carriers raising their minimum rates and starting to push back where they were not met. Financial institutions continue to be a reported target growth area for Cyber based on strength of controls, including strong commitment and investment in cybersecurity posture in line with regulatory requirements.

Cyber claims are being reported at a steady rate, with some severity being reported. 32% of underwriters surveyed ranked Cyber as the first or second line of coverage producing the most claims activity last year. New trends continue to emerge, including privacy risk based on evolving state-by-state privacy regulations and numerous variations of systemic events impacting various industries (CrowdStrike, Change Healthcare, CDK, etc.). Several industry Cyber reports note that the percentage of cyber claims against financial institutions as an industry increased in frequency between 2023 and 2024. As the claims landscape develops in 2025, underwriters will continue to scrutinize the strength of the insured’s cybersecurity posture (likely becoming stricter with control requirements) for most favorable renewal results. Given the volume and nature of information held by financial institutions, which often attract threat actors (as demonstrated by the most recent targeting of insurance companies by the cyber threat actor Scattered Spider), being able to demonstrate commitment to heightened controls will be critical. Our survey reflected that 43% of underwriters ranked Geopolitical risk as their first or second ranked top emerging risk for the sector (and which predated Israel/Iran military activities in the Middle East).

Several markets advised that claims in the FI space are being reported at a steady or increasing rate to multiple policies, triggering multiple coverages. To that end, carriers are offering more flexibility surrounding blended coverage forms and are approaching underwriting for a variety of packaged policies (including E&O, D&O, EPL, FLI and Cyber) with more accommodation.

Further, based on competition, Cyber carriers are developing ways to differentiate themselves through pricing, coverage enhancements and providing expanded proactive and reactive Cyber services to their insureds. These services can include tabletop exercises, incident response planning, phishing tests, etc. at a discount or on a complimentary basis.

Survey Results Across all Segments