Pharmacy Benefits

2025 PBM Industry and Market Update | October 2025 Edition

2025 PBM Industry and Market Update | October 2025 Edition

PharmaLogic® Spotlight communications explore evolving pharmacy dynamics and emerging trends that influence drug utilization and cost, supporting informed benefits decision-making.

Inside this PharmaLogic® Spotlight:

- New Drugs Influencing Benefits

- Federal Regulatory Activity Impacting Drug Costs

- Vaccine Confusion

- State Legislation Altering Pharmacy Benefits

- New and Expanding Use of GLP-1s

- Anti-inflammatory Biosimilar Use

- Shifting Mix of Injectable Drugs

New Drugs Influencing Benefits

Clinical research continues to produce new drug innovations and uncover new uses for existing medications. The Food and Drug Administration (FDA) has approved 41 new drugs and 2 new gene/cell therapies so far in 2025. Significant advancements in the treatment of rare diseases are offering new hope to patients, while also posing financial challenges for plans as they manage expenses. In 2024, specialty medications accounted for approximately 70% of all new drug approvals, with over half of newly approved drugs in 2025 falling into this category. Notably, one-third of these approvals target various forms of cancer. Additional applications for new drugs are still pending FDA decisions, signaling that this trend is likely to continue.

Recent approvals include:

- Inluriyo™, Hernexeos® and Modeyso™ for cancer

- Andembry® and Dawnzera™ to prevent and Ekterly® to treat hereditary angioedema (HAE) attacks

- A new indication for Wegovy® to treat MASH (metabolic dysfunction-associated steatohepatitis), a form of fatty liver disease

- Brinsupri™ for bronchiectasis, a chronic lung disease

Approvals pending FDA review:

- New oncology drug options for ovarian and other cancers

- Additional cardiovascular medications to treat obstructive hypertrophic cardiomyopathy and inhibit platelets

- Tolebrutinib for Multiple Sclerosis

- A once-a-week insulin for diabetes patients

- New gene therapies for melanoma and rare diseases

Federal Regulatory Activity Impacting Drug Costs

Drug costs continue to be a prominent concern garnering a tremendous amount of attention from the White House and federal legislators.

- Most Favored Nation (MFN) executive order: The Trump administration challenged pharmaceutical manufacturers to present plans to align prices for brand drugs in the US with the lowest prices (MFN price) paid by other developed countries. The first agreement with Pfizer was recently announced. It will provide MFN prices to state Medicaid programs and discounts to patients buying drugs directly from Pfizer.

- TrumpRx online: President Trump introduced a plan last month to launch an online platform directing Americans to lower-priced drugs available by way of most favored nation efforts. Senior administration officials provided a target of early 2026 to introduce the site.

- Tariffs on imported pharmaceutical products: Tariffs are intended to persuade pharmaceutical manufacturers to move more manufacturing to the U.S. and lower prices. A 100% tariff on branded drug products from certain countries, set to be imposed on October 1, has been put on hold. If enacted, the 100% tariffs will impact drugs from the UK, Canada, Mexico, Switzerland and other countries. Products from the European Union and Japan are subject to a 15% tariff based on a trade agreement completed earlier this year.

- Direct-to-consumer drug advertising: A recent federal directive was issued calling on the FDA to take action to ensure direct to consumer drug advertising presents balanced and complete information.

- Patents: Legislative efforts are underway to reform drug product patents and limit anti-competitive patent practices that prevent or delay the release of generics or biosimilars.

- The Inflation Reduction Act (IRA): Signed into law in August 2022, this sweeping federal law includes key healthcare provisions allowing Medicare to negotiate prices for certain high-cost drugs, capping out-of-pocket costs for Medicare Part D beneficiaries and limiting insulin costs to $35 per month for Medicare enrollees.

Vaccine Confusion

Recent decisions made by the FDA, Centers for Disease Control and Prevention (CDC) and the CDC’s Advisory Committee on Immunization Practices (ACIP) are creating uncertainty and confusion about vaccines. In the past there was consensus about vaccine recommendations and schedules between federal agencies, federal and state regulations and specialized medical guidance. Following recent FDA decisions related to COVID-19 vaccines, changes to the ACIP panel membership, hiring and firing decisions at leadership levels of the CDC and decisions made at a recent ACIP meeting there is now discord.

Department of Health and Human Services (HHS) Secretary Kennedy appointed new members to the Centers for Disease Control and Prevention (CDC) Advisory Committee on Immunization Practices (ACIP), replacing all seventeen members previously holding committee positions. The changes to ACIP membership prompted strong reactions from infectious disease and vaccine specialists in the medical community.

COVID-19 Vaccines

- In late August, the FDA issued new guidance related to COVID-19 vaccines supporting boosters only for people ages 65 and over and patients 6 months and older with conditions that put them at high risk for severe outcomes from COVID-19.

- During its September meeting, ACIP voted to change the pediatric and adult immunization schedules for the COVID-19 vaccine to state that for anyone six months and older the decision to vaccinate should be based on shared clinical decision making between the patient and provider after discussing the risks vs. the benefits. On October 6, 2025 the CDC announced that the ACIP recommendations have been adopted.

- The disconnected and fragmented information released by federal agencies, as well as input from several medical associations, has resulted in confusion among patients, pharmacies and caregivers.

State Legislation Altering Pharmacy Benefits

Common state legislative targets include formulary and utilization management restrictions, pharmacy reimbursement mandates and restrictions to pharmacy steerage, regulation of group purchasing organizations (GPOs) and rebate aggregators and not permitting pharmacy ownership by PBMs or insurers. These actions can limit a plan’s flexibility to administer a benefit and restrict use of plan design features that encourage the use of lower-cost options. These new legislative rules can raise prescription benefit and healthcare costs, limit member choice and require that national and regional plans deal with an array of state-specific benefit administration regulations. Most recently, new legislation and laws in AR, AL, CA, CO, IA, IL, IN, KY, LA, NJ, TN, TX are impacting plans.

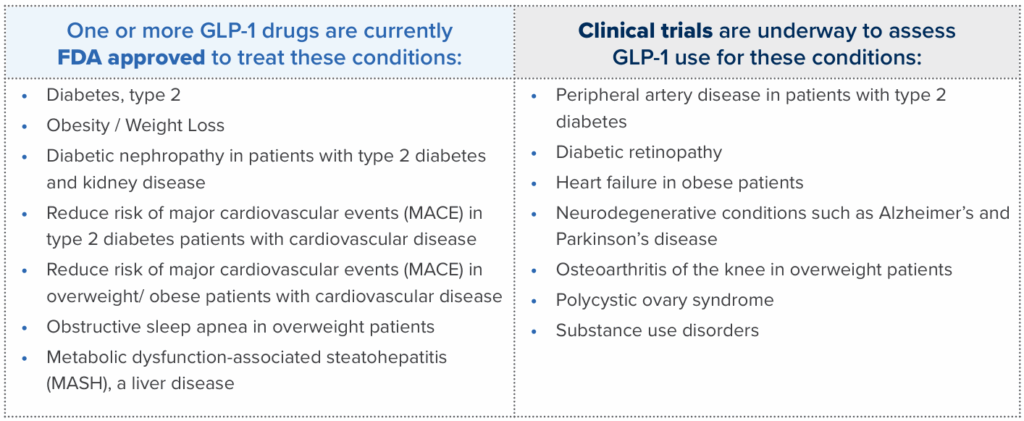

New and Expanding Use of GLP-1s

Use of and expenditures for GLP-1* medications have dominated recent trends for many plans, especially those covering both diabetes and weight-loss GLP-1 drugs. PharmaLogic® data for year-to-date 2025 reveals that 10% of total Rx benefit gross costs are attributed to diabetes GLP-1 medications. For plans that cover GLP-1 drugs for weight loss, the percentage of gross cost is even higher. Plan costs will vary based on factors such as population demographics, diabetes prevalence and other utilization drivers. New uses for GLP-1 drugs continue to be a major focus in clinical trials. As additional therapeutic uses for these drugs are approved, use and costs may continue to increase.

Brown & Brown can assist you in discussions with PBMs and disease management providers to refine your benefit approach to weight loss and other uses for GLP-1 drugs.

- Evaluate disease and nutritional management programs to support meaningful clinical and financial outcomes

- Ensure updates are made to PBM prior authorization criteria to incorporate new FDA approved indications

- Review direct-to-consumer options for weight loss GLP-1 drugs

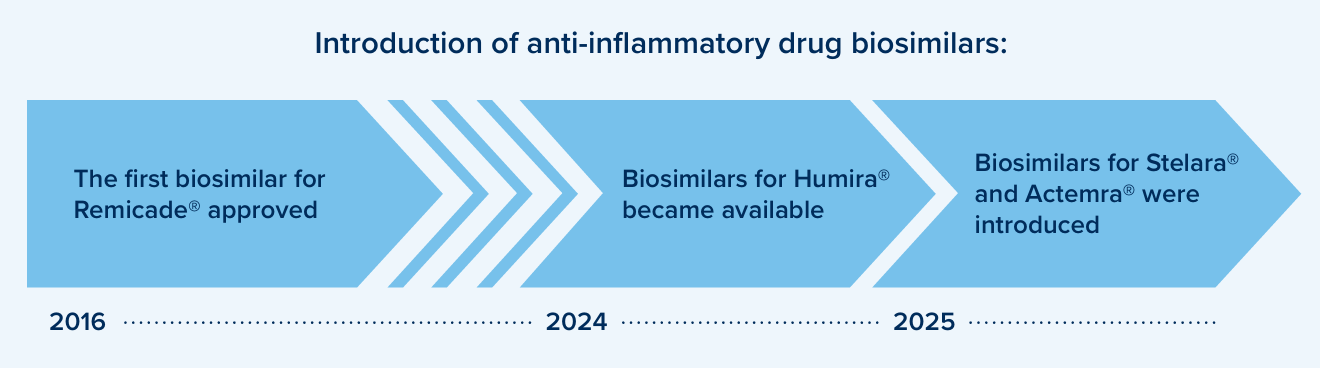

Anti-Inflammatory Biosimilar Use

Anti-inflammatory drugs continue to be the top category of drugs for many plans based on cost. Most of these medications are specialty biologic drugs such as Humira®, Stelara®, Skyrizi®, Dupixent®, Enbrel® and Rinvoq®. When patents for brand biologic drugs expire, lower cost biosimilar options often become available. Several biosimilars are now available in this class of drugs presenting savings opportunities.

Brand patent litigation or supply chain shortages can impact biosimilar availability. Drug formularies may continue to prefer the original, reference brands along with biosimilars for certain drugs until the market stabilizes.

Consider plan design options that encourage use of biosimilar options, such as:

- Formulary strategies to prefer biosimilars and exclude coverage of the reference/ originator brands in certain situations to encourage use of lowest net cost options

- Press PBM partners to demonstrate savings net of rebates to help monitor and ensure success with biosimilar strategies

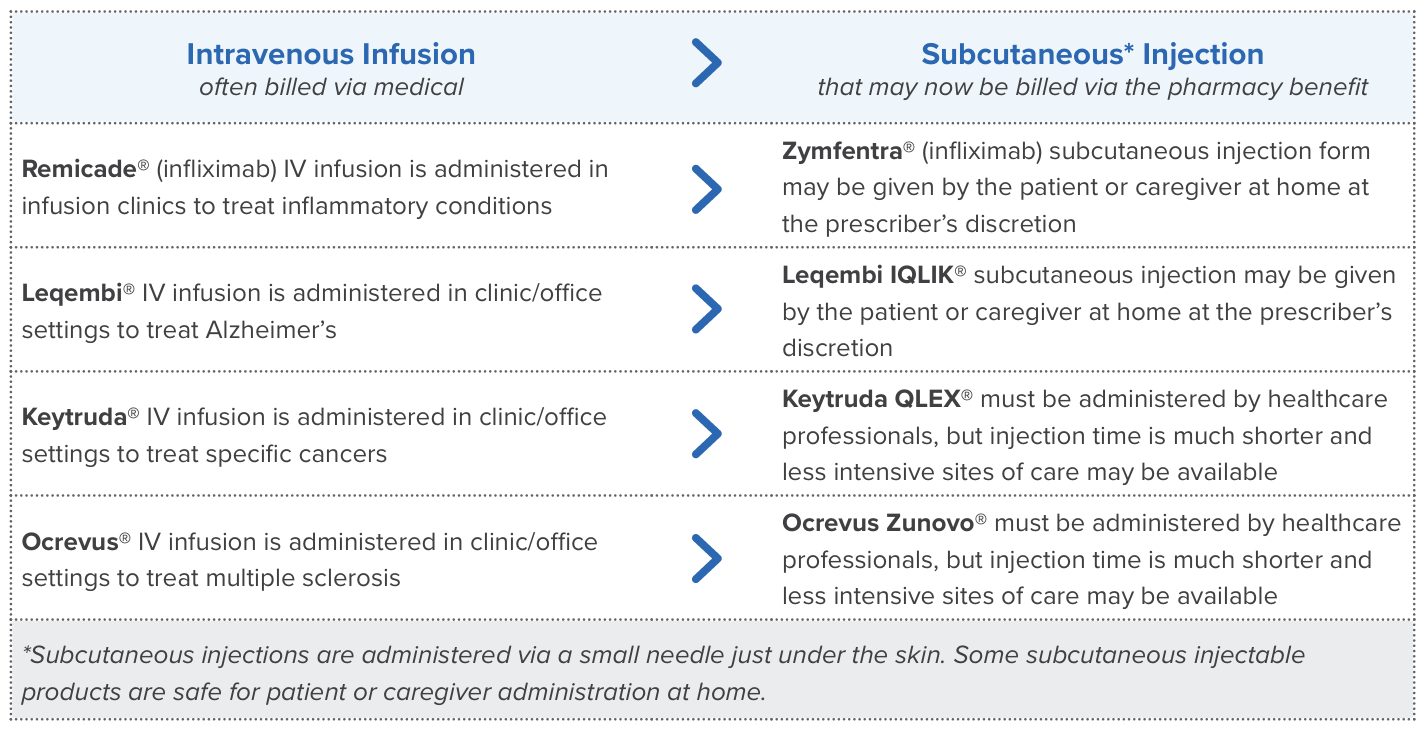

Shifting Mix of Injectable Drugs

The mix or blend of drugs changes over time in a prescription benefit as new drugs are introduced, prescribers prefer specific therapies and new patients enter a benefit plan. The increasing use of GLP-1s is an example of changing drug mix that has had a significant impact on many benefit plans.

Injectables are routinely covered in pharmacy benefits, especially those that are self-injectable. As additional injectables are introduced, some replace, or supplement, intravenous medications administered in outpatient hospital clinics and other professional settings. When this happens, a shift in cost from medical to pharmacy benefits is possible.

Recently, four injectable products were introduced to the market and may contribute cost to pharmacy benefits and shift spending from the medical benefit.

Explore injectable drug use:

- Consider discussions with medical carriers and pharmacy benefit managers to review use of injectables

- This type of investigation may elicit opportunities for more efficient care delivery and possible savings for the overall health benefit