Pharmacy Benefits

2025 PBM Industry and Market Update | July 2025 Edition

2025 PBM Industry and Market Update | July 2025 Edition

PharmaLogic® Spotlight communications review evolving pharmacy dynamics and trends driving prescription drug use and cost and guide benefits decision-making.

Inside this PharmaLogic® Spotlight:

- New Drugs Influencing Benefits

- Legislation Impacting Drug Costs

- Vaccine Season is Approaching

- Maximizing use of Biosimilars

- What’s Next for GLP-1s?

New Drugs Influencing Benefits

Amidst the many leadership and staffing changes occurring in federal agencies early in 2025, the Food and Drug Administration (FDA) has approved 20 new drugs and 2 new gene/cell therapies. Other new drug applications are pending FDA decision and may push the total number of new approvals to over 30 by the third quarter of this year.

Dr. Martin Makary, the new commissioner of the FDA, has outlined priorities that include faster evaluation of new drug applications using artificial intelligence tools for the first review of application documents.

Recent approvals include:

- Yeztugo® injection for HIV pre-exposure prophylaxis (PrEP)

- New COVID-19 vaccines NuxavoidTM and mNEXSPIKE®

- ImaavyTM for myasthenia gravis

- Tryptyr® for dry eye disease

- Andembry® to prevent hereditary angioedema (HAE) attacks

Approvals pending FDA review:

- New oncology drug options for ovarian and other cancers

- Subcutaneous injectable form of Leqembi for Alzheimer’s (current form of Leqembi is intravenous)

- tolebrutinib for Multiple Sclerosis

- Additional drugs to treat or prevent hereditary angioedema (HAE) attacks

- New gene therapies for melanoma and rare diseases called mucopolysaccharidosis IIIA/IV and recurrent respiratory papillomatosis

Legislation Impacting Drug Costs

Federal and state legislators continue to be busy proposing and enacting rules related to prescription benefits and drug prices.

Some legislative actions can limit a plan’s flexibility to administer a benefit and restrict use of plan design features that encourage the use of lower-cost options. As a result, new rules can raise prescription benefit and healthcare costs, limit member choice and require that national and regional plans deal with an array of state-specific benefit administration regulations.

Federal

Executive orders and congressional activities that are intended to lower drug prices:

- CMS negotiated pricing, mandated by the Inflation Reduction Act, for 10 drugs starting in 2026 and for 15 drugs starting in 2027.

- The ‘Most Favored Nation’ executive order aims to align prices for brand drugs in the US with prices in other developed countries and establish consumer direct purchasing.

- Tariffs on imports from other countries may impact the cost of both raw pharmaceutical ingredients and completed drug products.

- Medicare inflation protection via rebates if drug prices rise faster than the rate of inflation.

- Proposed legislation would eliminate direct-to-consumer advertising of prescription drugs

- Cost-sharing limits on certain drugs such as insulin.

- Legislation impacting prescription benefit arrangements that includes spread pricing when pharmacies are paid an amount that differs from what a plan pays, the percentage of rebates received by plans and how plans distribute and use rebate dollars.

State

Key themes of state legislation related to prescription benefits and drug prices include:

- Formulary and utilization management (UM) restrictions.

- Pharmacy reimbursement mandates such as NADAC pricing.

- Limits to pharmacy steerage and any willing provider mandates.

- Erosion of ERISA preemption for private employee benefit plans.

- Restrictions on PBM activities and vertical integration/ownership of pharmacies. Lawsuits have been filed by PBMs opposing the Arkansas bill that restricts pharmacy ownership in the state.

- Pivotal new regulations were recently enacted in Alabama, Arkansas, Colorado, Illinois, Indiana, Iowa, Nebraska and North Dakota and are pending action in Texas. Many states have passed bills focused on PBM activities.

Your plan’s benefit design and strategies may be impacted by legislation.

- Consider joining advocacy efforts to make your plan’s voice heard at both the federal and state level to support legislation that permits the use of benefit options driving towards affordable benefits and oppose legislation that limits options and adds to plan spend.

- Contact your PBM to ask about legislation affecting your plan. The PBM may be able to estimate patient disruption and financial impact.

- Consult your legal counsel for guidance related to benefit design, coverage and ERISA-related changes.

What is NADAC?

NADAC or National Average Drug Acquisition Cost is a pricing index estimating the average drug price paid by pharmacies. The Centers for Medicare and Medicaid Services (CMS) conducts a monthly survey using a random sample of retail pharmacies (mail and specialty not included) to provide data. NADAC prices are not available for all drugs.

Vaccine Season is Approaching

Vaccinations are more frequent from September through January each year as patients receive their annual influenza vaccine and, more recently, COVID-19 vaccination updates.

- Influenza vaccines are updated for the 25-26 season.

- New FDA guidance related to COVID-19 vaccines supports boosters for people ages 65 and over and patients 6 months and older with conditions that put them at high risk for severe outcomes from COVID-19. The FDA will now require studies to show the benefit of ongoing annual COVID-19 shots for healthy adults under age 65. These updates along with lower use of booster shots in the last 2 years may signal declining use of COVID-19 vaccines this season.

HHS Secretary Kennedy recently appointed new members to the Centers for Disease Control and Prevention (CDC) Advisory Committee on Immunization Practices (ACIP), replacing all seventeen members previously holding committee positions. The changes to ACIP membership prompted some strong reactions from infectious disease and vaccine experts in the medical community.

The new ACIP panel announced that it will review immunization schedule recommendations, cumulative effects of vaccines, and the safety of thimerosal, a preservative used in multi-dose vials of influenza vaccines.

During its first meeting on June 25-26, 2025 the new ACIP panel voted to support existing CDC recommendations for annual influenza vaccination for all people over 6 months old and voted to recommend use of influenza vaccines that do not contain the preservative thimerosal. Thimerosal was removed from most vaccines years ago and only remains in some multi-dose vials of influenza vaccine.

Maximizing use of Biosimilars

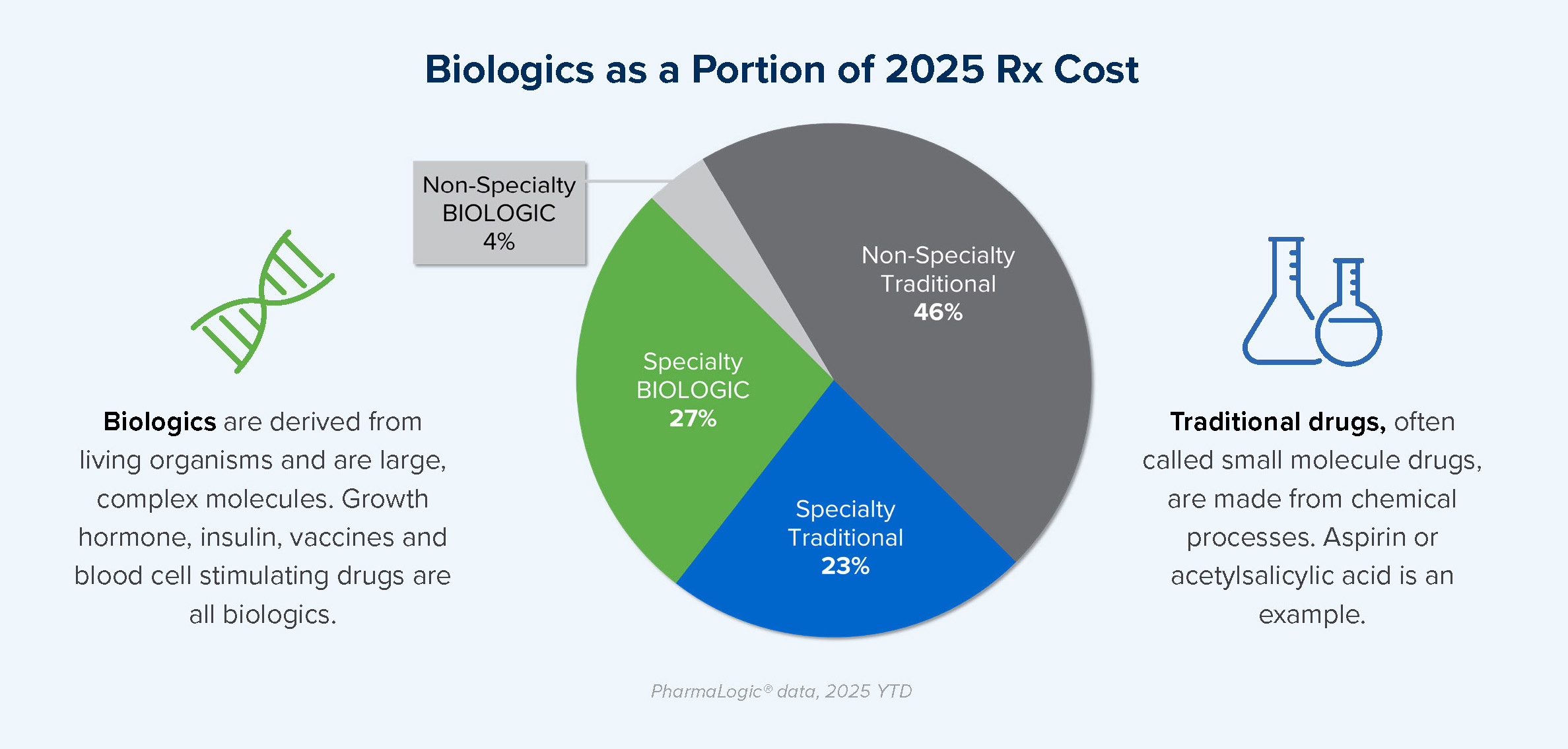

PharmaLogic® data for 2025 year-to-date reveals that more than half of specialty drug spend is related to biologic drugs. Biologics are not new, but the introduction and use of new biologics is occurring at a rapid pace.

When patents for brand biologic drugs expire, lower cost biosimilar options become available. While biosimilars have been available for some biologics since 2015, use became more prominent when Humira® biosimilars entered the market in 2024. Stelara® and Prolia® biosimilars became available in 2025 and biosimilars for Xolair® and Soliris® will soon join the mix, presenting additional biosimilar savings opportunities for prescription benefit plans.

Focused and aggressive formulary strategies to prefer biosimilars and exclude coverage of the reference/originator brands are key to achieving the greatest biosimilar savings.

What’s Next for GLP-1s?

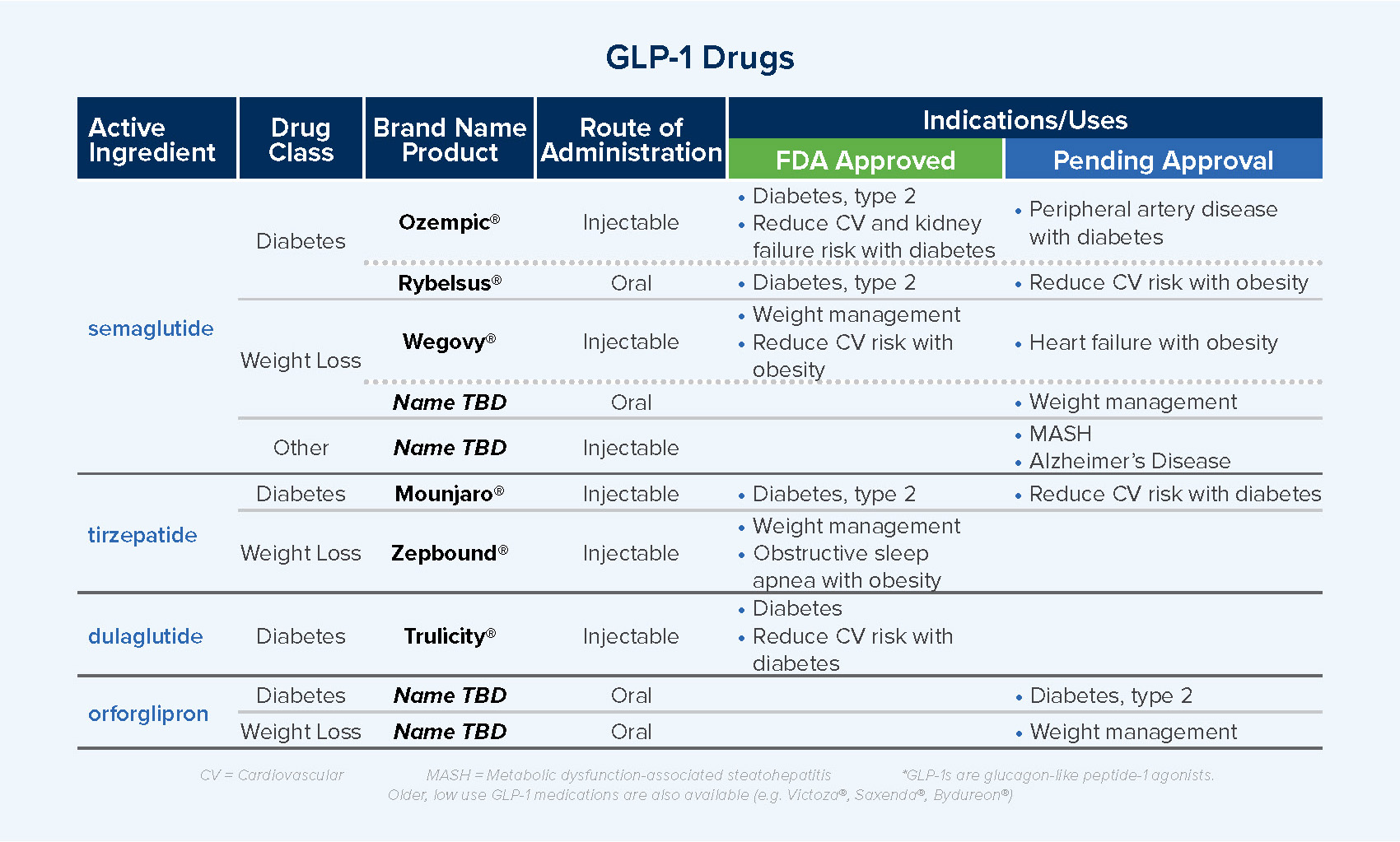

Growth in use and associated high-cost trends with GLP-1 therapies continue to create concern and urgency among benefit managers seeking to manage costs and ensure positive healthcare outcomes.

New GLP-1 options and additional indications, or uses, for these medications are in development and awaiting approval. Additional GLP-1 therapies and uses may expand the patient population using these drugs but will also create more competition in the marketplace, supporting cost management.

- Ongoing clinical trials for new drugs focus on long-acting drugs and drugs that effectively support weight loss while retaining muscle.

- Near-term approvals are expected for oral semaglutide for weight management and for injectable semaglutide for heart failure with obesity as well as metabolic dysfunction-associated steatohepatitis (MASH), a form of liver disease.

Benefit plans are exploring strategies to help balance cost and increasing patient demand for weight loss GLP-1s:

- Utilization management to ensure patients meet body mass index (BMI) criteria

- Excluding the drugs from coverage

- Singular/preferred drug manufacturer coverage

- Limits to coverage

- Higher copays to increase patient cost-share

- Patient support and weight-focused programs to guide appropriate drug use, reinforce healthy behaviors, support medication adherence, and promote wellness. Some plans require participation in this type of program to authorize continued plan coverage of weight loss drugs.

Our team is ready to assist you as you face new prescription benefit challenges and contemplate benefit changes and potential solutions. Together, we can review strategies with PBMs, including optimizing formulary incentives to support biosimilar use and utilization and behavioral management related to new and continuing drug therapies.

About PharmaLogic®

PharmaLogic® is Brown & Brown’s proprietary pharmacy data analytics platform that enables millions of dollars of annual financial savings and provides intelligent clinical analytics that positively impact individual medication access and improve overall population health. PharmaLogic® is leveraged for PBM contract modeling, PBM RFPs and/or negotiation, ongoing claims monitoring, advocacy and management, and consulting services to ensure that customers understand plan design, trends, forecasts, and issues that impact spend and population management.